Consumer loan system - live in 6 months

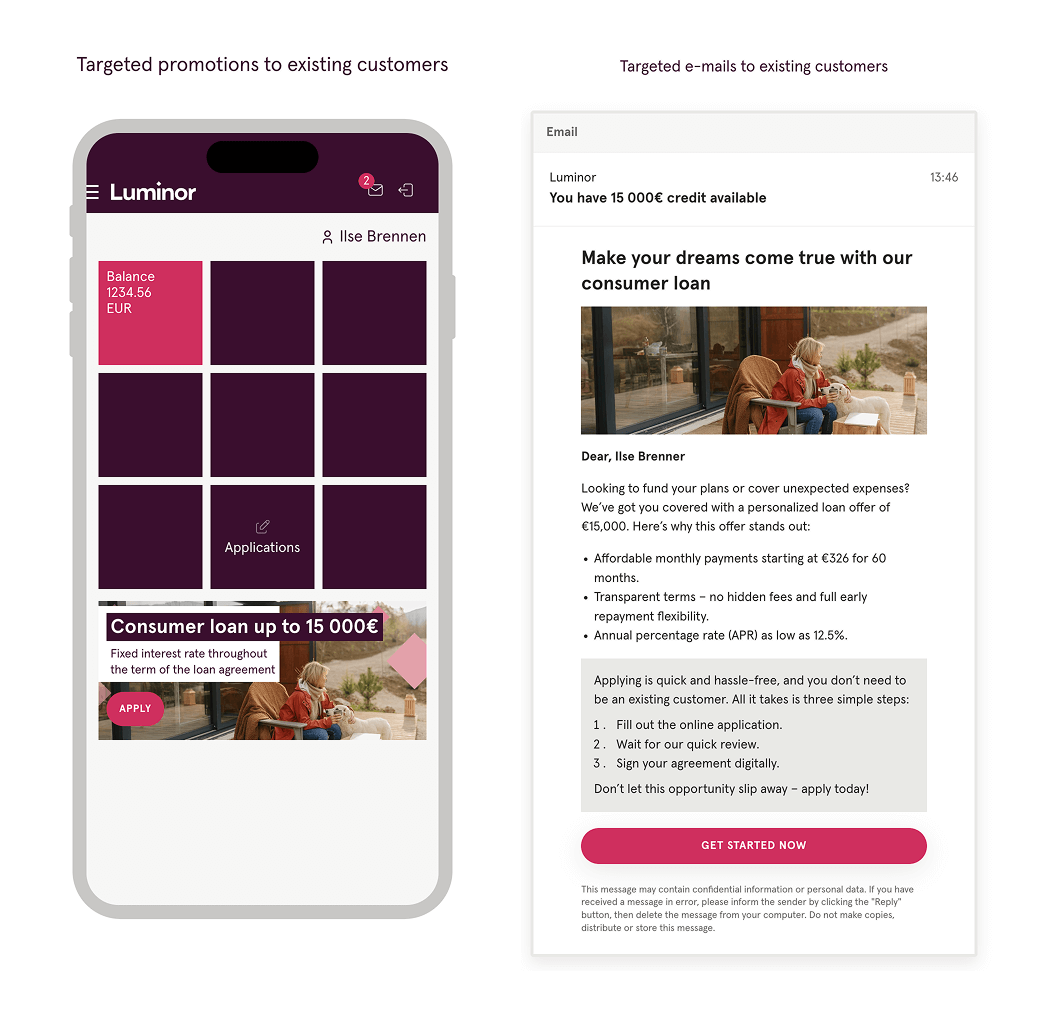

Our customer, Luminor, a bank formed from the merger of Nordea’s and DNB’s Baltic operations, sought to modernize its systems.

The new CTO’s team was looking for a partner who could take consumer credit issuance to a new level and reduce the lag that big mergers often cause by shifting the development focus internally for a while. We have recently built several custom systems that support modern credit businesses, and we have taken advantage of the opportunity.

What was done?

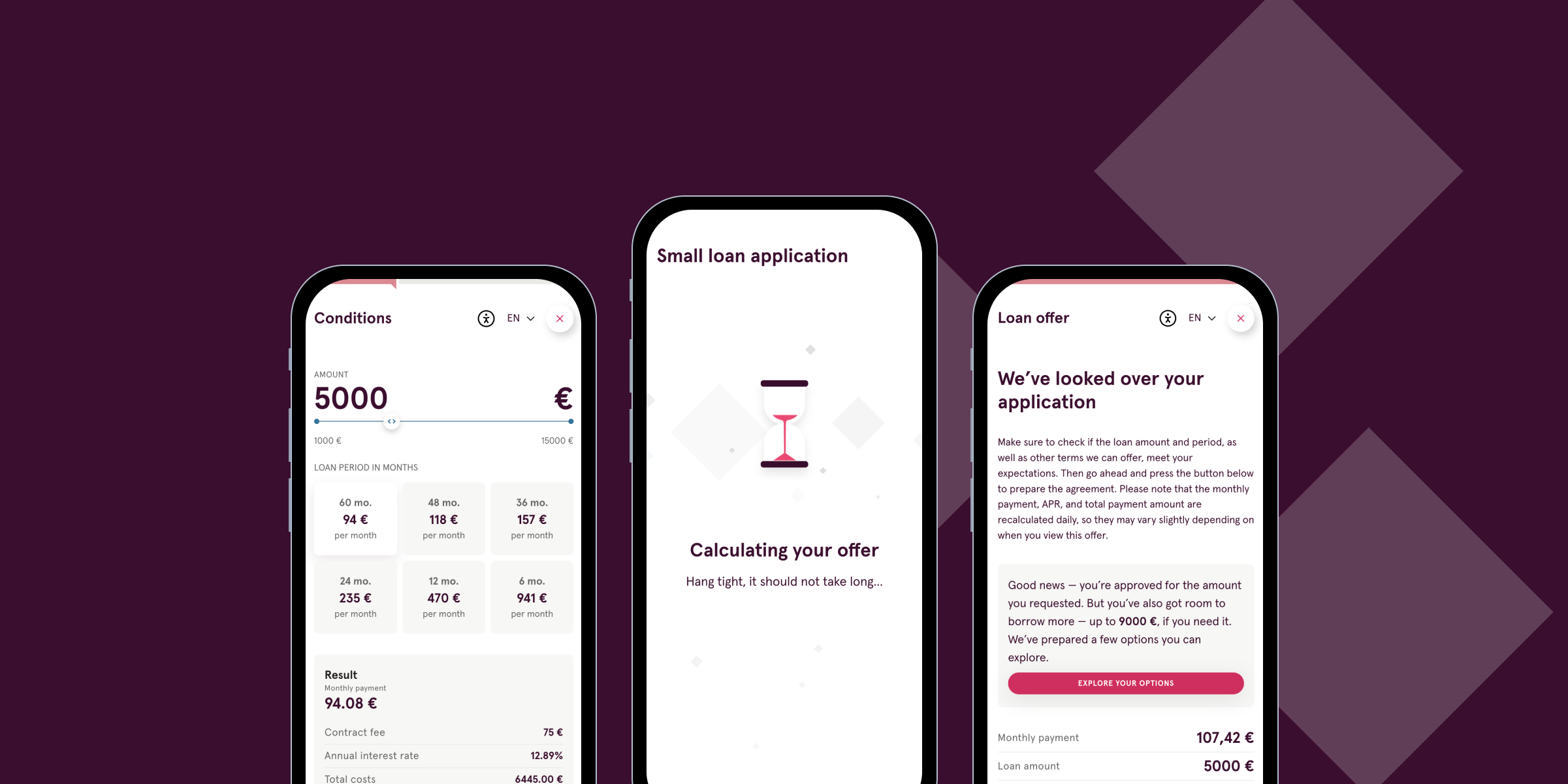

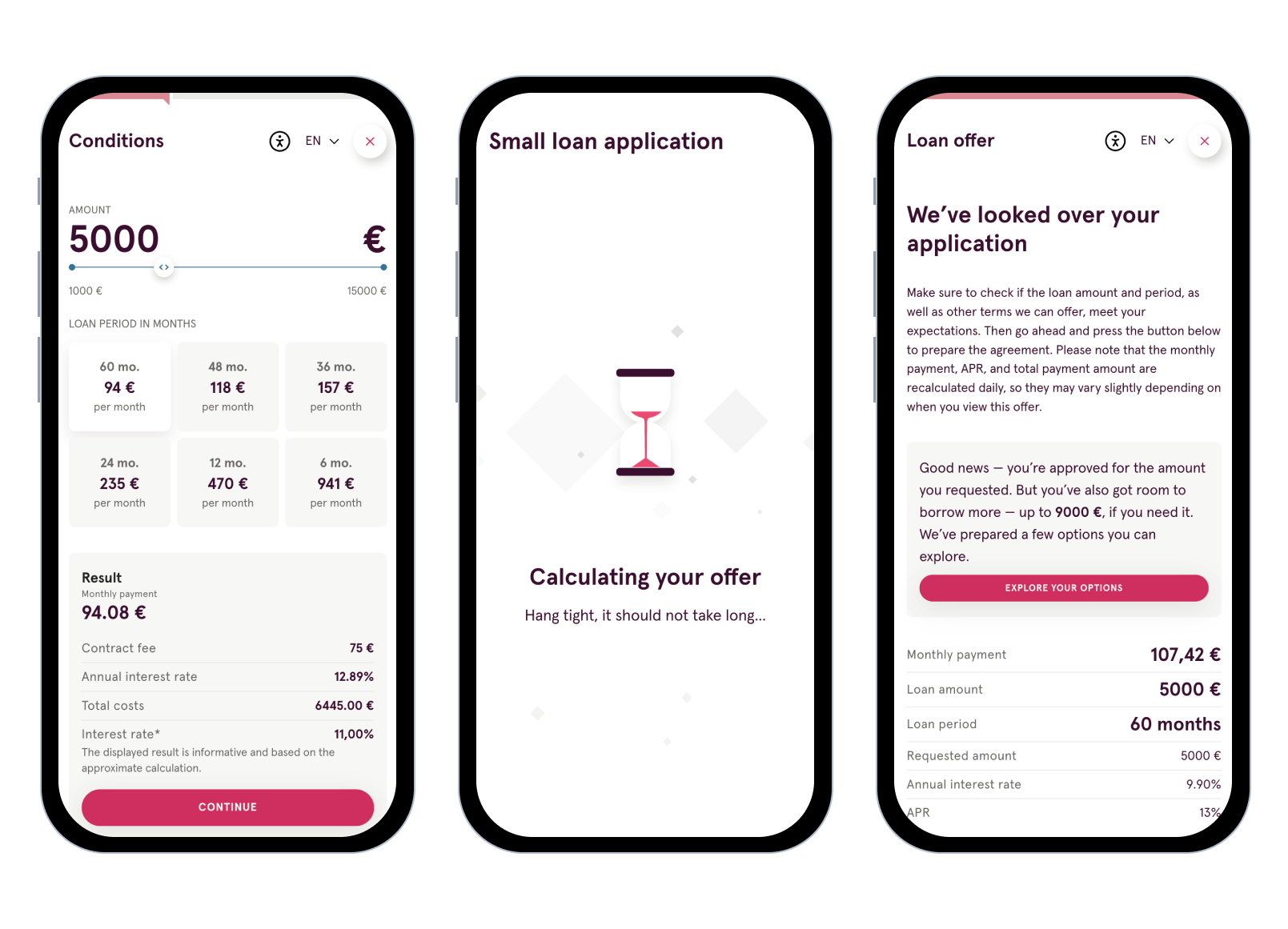

We got the mandate to start from “the clean sheet” and build the new consumer loan system. The existing system required a significant amount of manual work, which hindered sales and did not provide sufficient flexibility in managing decision-making rules, as the market demanded. The ultimate goal was to enable bank customers to obtain a cash loan within 5 minutes.

Additionally, the new system needed to be cloud-based to replace the slow and inefficient on-premise system, which added even more complexity for the project, as, in parallel to business flow, we needed to use brand new infrastructure.

Fast start with a prototype

We got going the usual Codeborne way, by building first the prototype. This relatively low-cost approach enables, in a matter of days or weeks, depending on the size and complexity of the task, to walk through the main user flows.

The result of the prototyping phase is an agreement on what needs to be built. A storyboard. In this case, it took just a week before the developers joined. Our joint mandate was strengthened already some weeks later, when, during the demo to the CTO, everyone was positively surprised, how much of the prototype was already developed for the actual system.

Small teams achieve a lot

Typical for a project of that magnitude, our team was mostly 2 pairs of developers. The third pair joined in the later phases, and UI/UX experts participated on demand.

Build only what is necessary

With the MVP mindset, we built as little as possible and as much as necessary. In this context, we use the existing loan management system for contract and debt management and have added the entire application flow, decision-making and rules management, and contract creation.

This sped up the project and, among others, enabled us to go live in this short 6-month timeframe. One can always return to renew other parts of the loan management system, but we are live and enabling new business already. It is important to note here that we implemented the scoring engine as an API that can be used by any other bank system.

Agile mindset

With this project, the new CTO’s team was introducing Agile working principles to the organization. In the past, the common practice was the waterfall. The analysis had to be ready, then came development time, and upon finishing, the project team was dismissed. We had quite a detailed analysis as input in this case as well, all the way down to error messages, which in reality were used only partially. Our practice shows that things are changing significantly during the development process, and one can not foresee all the details before actually starting the project.

Agile in an established enterprise does not come easily, for sure. We were lucky and had an experienced and result-oriented business and IT team working with us at Luminor. This proved once again how important a strong product owner is for Agile projects to succeed. The project team had to work daily to ensure access, environments, etc, to keep the project running at the desired speed. A key success factor was the establishment of the new QA team, which enabled our work to reach the live environment quickly.

Multi-country approach

Luminor operates in all Baltic countries. Although our initial focus was on Latvia, where we are now live with the application, we have maintained multi-country readiness in mind, as other countries will follow soon.

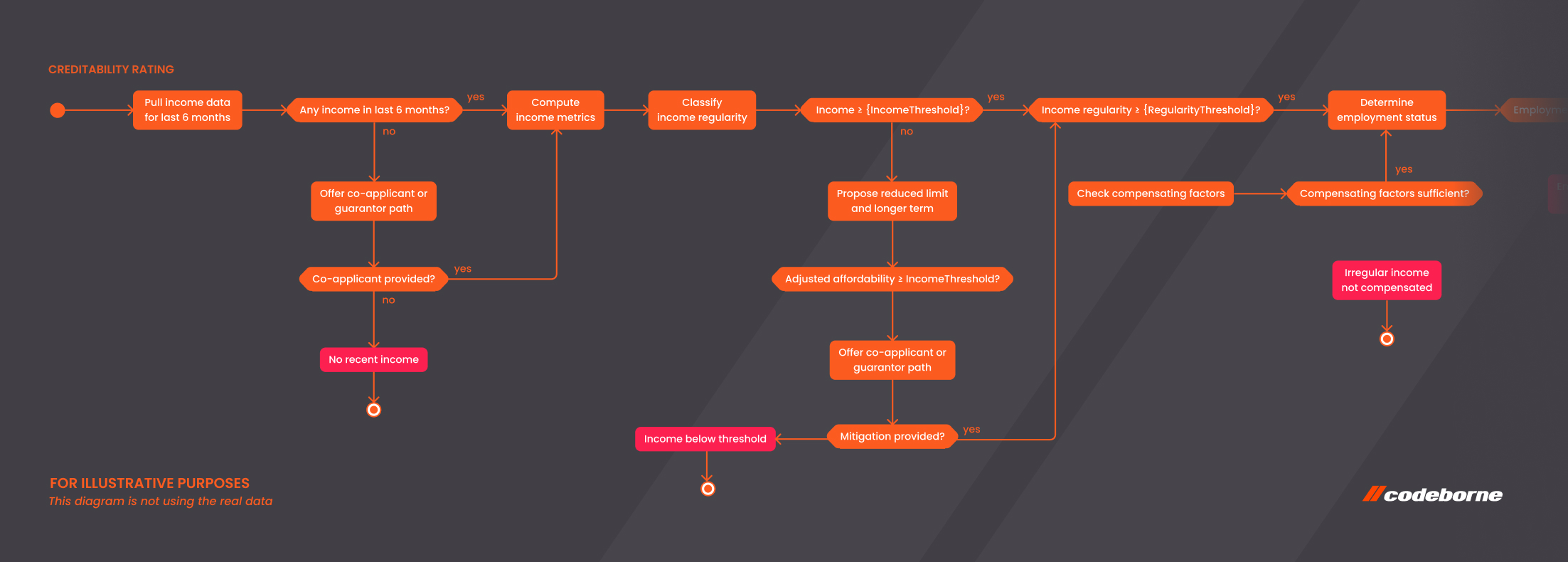

Flexible decision-making engine

One of the key components of the new system is the custom decision-making engine. We gave the risk managers a powerful tool, where they can play through various scenarios by changing tens and tens of parameters on production data to see the impact. Flexible, secure, and auditable. The first days and weeks of being live have already given the team valuable feedback. We know that the customer is already playing around with the risk engine, as the initial setup was too conservative and resulted in too few accepted applications.

Multiple integrations

Building a credit management system means, obviously, several integrations. In more detail:

- Accountscoring (Taust) - trustworthy account statements of customers from all banks operating in the Baltics.

- KIB - Latvian Credit Bureau to get relevant financial data of customers

- eParaksts - electronic identification/signing method available in Latvia

- Smart-ID - signing the contract

- integrations with the external notification systems. Plus, of course, several internal integrations with customer data and the data warehouse. As a very positive surprise, the cooperation with KIB and AccountScoring was very smooth - good documentation of the API and quick reactions to our questions from the support teams during the integration process.

Accessibility for all

With the European Accessibility Act in mind, all UI components were built to be compatible with the new requirements, just as in any other one of our ongoing projects.

This has been only the start of our cooperation with Luminor. Our teams are already eagerly working on several new projects while we write these lines.

How up-to-date are your systems? How flexible are you in adapting to market needs quickly? Would you like to get some true Agile training in action?

Our recent stories

The Codeborne Christmas beer brewing diaries

It was a sunny day in September. Quite warm for that time of year. We were sitting with my colleague Tiit on the roof terrace in the Codeborne office as we do every now and then. I ask him for advice on occasion - after all, what are the more experienced colleagues good for otherwise?

“Backing up” a good product owner

One of the key players in most successful agile projects is a product owner, at least in Codeborne’s practice. Our practice stretches for more than 15 years, during which we have successfully delivered over 100 projects.

Unleashing the power - How Creos partnered with Codeborne to change Luxembourg's energy sector

Creos Luxembourg involved Codeborne in its journey to modernize Luxembourg’s energy sector