1 app. 5 countries. In less than a year

How we helped IuteCredit scale their business in 5 countries

Our customer IuteCredit is in the consumer credit business, providing customers installment loans in 5 countries in the Balkan region since 2008. Headquartered in Estonia, the company invests significantly in technology to make the business more efficient and to stand out from the competition.

The situation in the target countries

These markets are by tradition quite used to the paper-based way of living. The downside for our customer was that processing applications on paper at some point meant exponentially growing HR costs. Likewise, the data quality asked for improvement. IuteCredit founders strongly believe that meeting customers online enables them to grow the business, improve the data quality and outpace the competition.

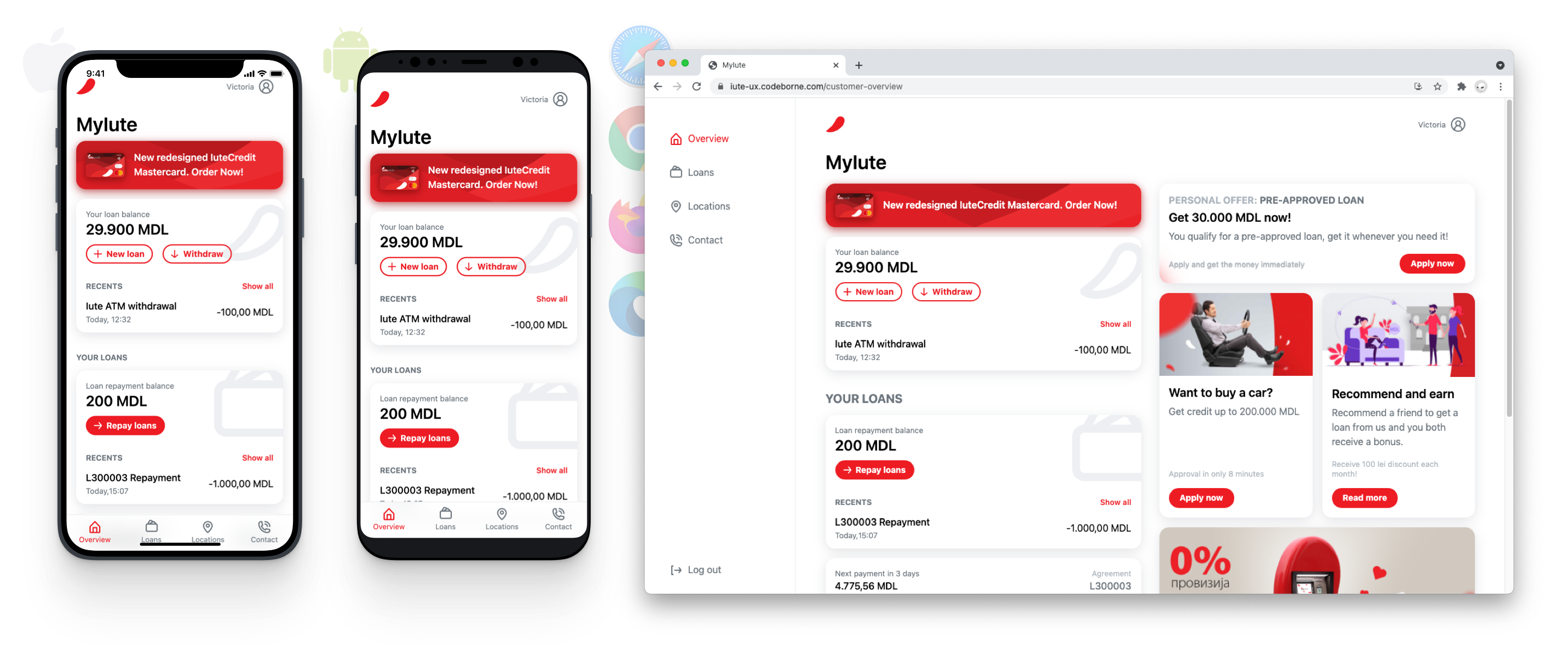

Looking at the fast growth of mobile phone ownership, “mobile first” was the message from our customer. In all 5 countries. Later all the features in the app should be accessible on desktops as well.

From prototype to live in 4 months

The first weeks we spent building only the prototype. We went through all the major user flows with the customer’s team. This short-timeframe low-investment approach has helped our customers in many projects to prepare for the eventual full-tempo development project. Very often using the future system as a customer reveals hidden questions and helps to answer them in due time.

For the front-end’s tech stack the customer gave us free hands. The high-fidelity prototype was built using Vue 2. The prototype looked and worked like a real app, everyone was able to use it on their phones to get the real look and feel. It looked so real that we needed to separately communicate that it was not the real app yet. It was easy for the customer to communicate within the organization’s different countries and branches what is going to happen and to get them onboarded before the back-end would even be developed.

Once the back-end development started, the UI from the prototype was fully used and practically no additional time was spent on the front-end developments. In parallel, some additional flows were developed for the prototype which was later on also implemented in the real app.

In about 4 months, the new MyIute app went live in the first country. In the next 6 months, the others followed. Fully localized. And all that was achieved by 1 pair of dedicated developers!

Why we chose the hybrid app path

Since we had a fair share of experience with hybrid mobile apps, we decided that this was a way to go in this project also. We also needed to consider that the customer needed to get to the market in the shortest timeframe possible. This meant ruling out the full native app development. The hybrid app basically means that we built separate native apps for Android and iOS, which technically are just wrappers for the common MyIute UI web application written in Vue 2.

The result was one of the most efficient hybrid implementations in Codeborne, which on top of the simplicity of code changes also enabled faster development time.

Adapting to multiple countries

Since each of the countries where the system is used has several differences in how they conduct their everyday business, we set up a very flexible configuration service. Via this tool, the customer can switch on or off required features as the need comes along. Likewise, by enabling this we saved the customer from further developments of the core banking system.

Technical particularities and challenges

Some more things added to the complexity of the project.

- The customer insisted on using the Amazon Amplify service to keep everything related to running and configuring the MyIute UI in the cloud. New to us, but survived.

- As Balkan countries do not have a common (or simple enough) system for logging the customers in, we used Amazon Cognito service for customer identification and access management.

- For virtual onboarding, the customer uses the GetID service in most countries it operates. Another very multi-faceted integration to get the entire flow working both for the eventual customers and the help desk to support the unhappy flows. By now we have successfully used GetID in several projects.

- For publishing the native apps to the Google play and Apple Store we used the Codemagic platform (previously named Nevercode). Having previously dealt with publishing by ourselves we appreciated how much valuable time we actually saved by using this platform.

- This project gave us lots plenty of experience in working through the comments of the Apple/Google moderation teams. In the beginning complex and inconsistent mobile app review processes of both Google Play Store and Apple’s AppStore were painfully slow. Now we can navigate through them quite easily.

When the customer needed a tool to onboard investors for their bond issuance in 2021, we built an Investor app on the same platform within a month. Re-used the design and several components. The reasonable step helped to save resources.

Business impact

By the time this story was published, the MyIute app alone has been cumulatively downloaded more than 450,000 times in the short time since its release. With MyIute in the hands of its customers, IuteCredit has increased its gross loan portfolio by more than 60% and customer base by 45% and keeps on growing and benefiting from the digital-first strategy.

Read how we enabled IuteCredit customers to sign agreements using their mobile phone’s biometric data

How can we expand your business?

Our recent stories

The Codeborne Christmas beer brewing diaries

It was a sunny day in September. Quite warm for that time of year. We were sitting with my colleague Tiit on the roof terrace in the Codeborne office as we do every now and then. I ask him for advice on occasion - after all, what are the more experienced colleagues good for otherwise?

“Backing up” a good product owner

One of the key players in most successful agile projects is a product owner, at least in Codeborne’s practice. Our practice stretches for more than 15 years, during which we have successfully delivered over 100 projects.

Unleashing the power - How Creos partnered with Codeborne to change Luxembourg's energy sector

Creos Luxembourg involved Codeborne in its journey to modernize Luxembourg’s energy sector