Our mobile banking solutions got noticed in Russia. Well noticed.

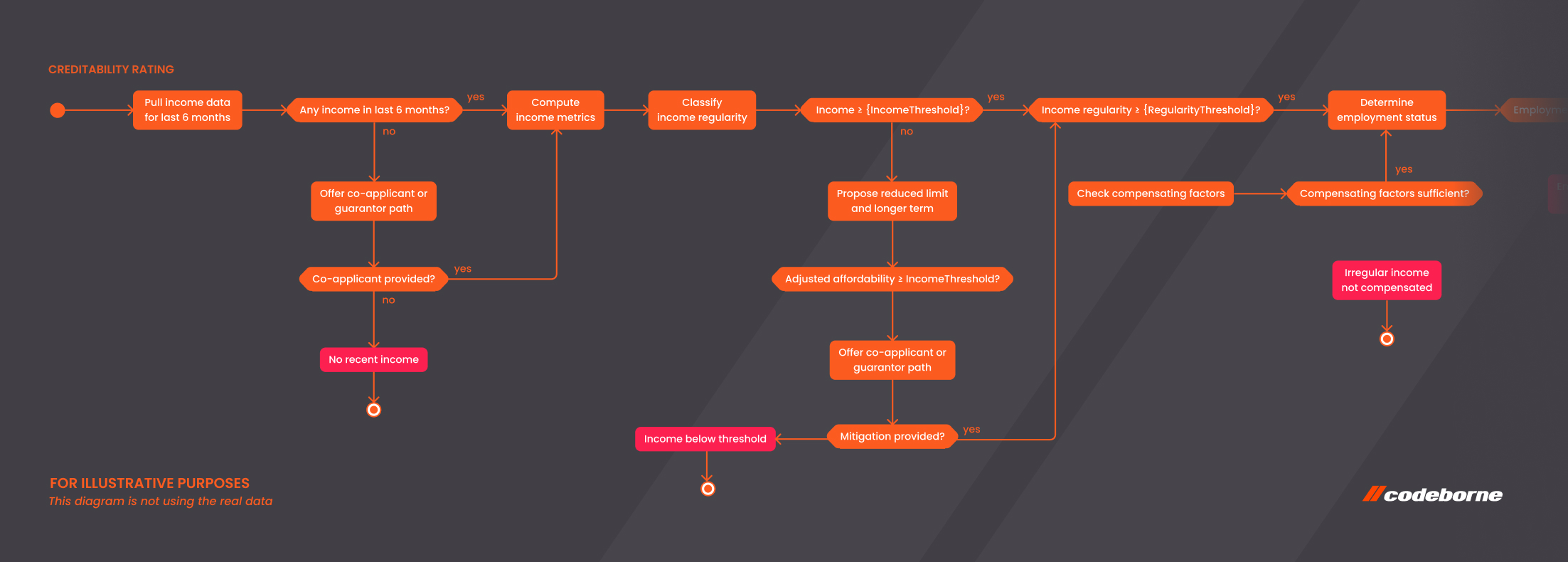

Markswebb Rank&Report analytics agency in Russia just released their 3rd annual ranking of Russian mobile banking solutions.

Both of our customers in Russia - Bank Saint Petersburg (BSPB) and Ural Bank of Reconstruction and Development (UBRD) - were well represented in the results.

Especially BSPB, where we launched new applications for both iOS and Android in September 2013 together with the release of iOS 7. BSPB mobile banking app took us to Top 5 in the ranks and earned even a special page in the report as a “success story”.

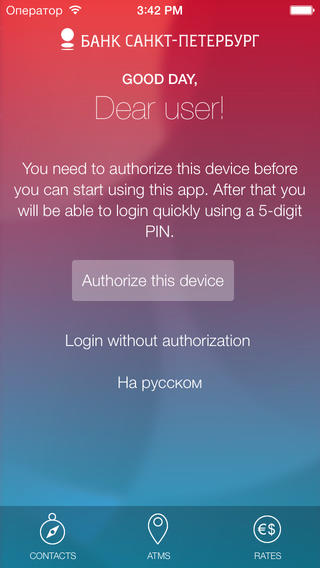

Anton, our lead in BSPB project, is not surprised about the success. Hard work that we put into improving design, UX and adding many new cool features, pays off. For instance, for quick access, users can authorise the device just to ask a PIN code for logging in and getting the latest info about account balance. Once inside, a “shake” with the phone will bring the balance on screen.

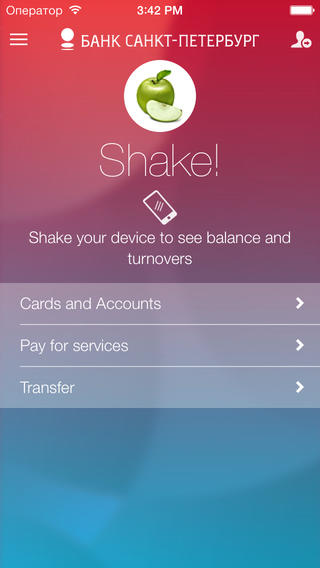

For more enjoyable banking experience, we wanted to free the users from entering long account numbers and other required credentials (and potentially messing up something), so we implemented “bump” transfers. It is enough to “bump” the phones with a person you want to pay or receive money from and all required info is pulled to the phone screens. Enter amount and voila! Next time you notice something like this in a bar, no worries, it’s a cash-free transaction taking place …

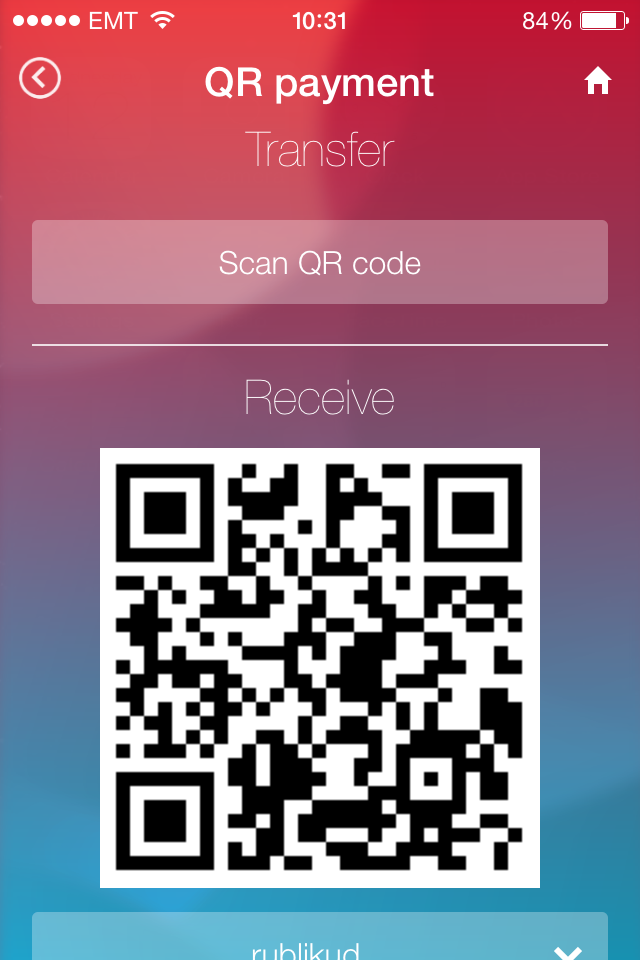

When there’s no one to bump with, then the same goal - easier and error-free payments - are enabled using QR codes. Important to note that this feature is as well compatible with Alfa bank, one of the top players in Russian market. We believe that using QR codes has a huge potential for payments in restaurants, bars, clubs etc.

Technically, we used hybrid approach to develop the banking mobile apps, reducing duplicate development efforts needed to support several mobile platforms to a minimum, producing two apps (iOS and Android) for the budget of one. In short, hybrid means building most of the code in cross-platform technologies (HTML5 and friends) and writing only a tiny fraction of native code for each platform, e.g. to implement smoother menus, some security features, QR code scanning with camera, shake detection, browsing of contacts, etc. Don’t get us wrong here: all HTML5 assets are part of the packaged app, so it will start nicely in offline mode and even show you the ATMs on the map even if internet connection is not currently available. Hybrid solution also allowed us to build a mobile web banking for the browser that is almost as good as the apps (sharing 90% of the functionality), which was in turn ranked #2 in Russia by Markswebb. For more info on development of Hybrid mobile apps, see Anton’s conference talk slides from Mobius Conf and DevConfu.

Important to note that UBRD, where we started to work in late 2013, was not even ranked in previous report and has moved to the middle of the ranks already.

We keep on working, listening to customer feedback and closely monitoring the trends in mobile applications.

More details on the agency’s website (in Russian)

Our recent stories

The Codeborne Christmas beer brewing diaries

It was a sunny day in September. Quite warm for that time of year. We were sitting with my colleague Tiit on the roof terrace in the Codeborne office as we do every now and then. I ask him for advice on occasion - after all, what are the more experienced colleagues good for otherwise?

“Backing up” a good product owner

One of the key players in most successful agile projects is a product owner, at least in Codeborne’s practice. Our practice stretches for more than 15 years, during which we have successfully delivered over 100 projects.

Unleashing the power - How Creos partnered with Codeborne to change Luxembourg's energy sector

Creos Luxembourg involved Codeborne in its journey to modernize Luxembourg’s energy sector